So you’re in the market for a pickup truck, but you don’t think you can afford to buy one outright? Leasing could be the answer. Leasing a pickup truck gives you all the practical advantages of owning one while allowing you to pay less up-front and spread out your costs over a longer period of time. But before making the commitment to lease a pickup truck, there are a few things you need to know. In this blog post, we’ll look at everything you need to consider before signing on the dotted line and leasing a pickup truck, including lease terms, mileage restrictions, your budget and more. Ready to dive in? Let’s go!

Quick Summary of Key Points

When leasing a pickup truck, it is important to consider your budget, needed features, intended use of the vehicle, the dealership or lender that offers the best terms, and the planned length of ownership. Additionally, you should research the available models and compare them side by side to get the most value for your money.

Size Matters: What Size Truck is Right For You?

When it comes to leasing a pickup truck, size does matter. Depending on your needs, you’ll need a larger truck to haul heavy or bulky items such as furniture pieces or building materials. Do you really want to limit yourself and wind up needing another truck right after leasing the first? That would be an added expense that can easily be avoided with proper foresight. On the other hand, if you’re only using it for everyday tasks, then a smaller model may suit your needs just fine.

The trick is to determine how large of a load you are expecting to transport and plan accordingly. For example, if you’re going to be moving large items around, like furniture or even appliances, then you may wish to go with a mid-size to large-size pickup truck. If all you need is something for occasional transportation of lighter items in everyday errands, then a compact pickup should suffice.

However, it’s also important to think about fuel efficiency when planning for size. Larger trucks require more fuel and cost more at the pump. It’s important to factor these variables into your decision.

Once you have figured out which size of truck best suits your needs, it’s time to look into understanding different types and sizes available. This way, you can accurately assess what kind of lease would benefit you most.

- According to Edmunds, leasing a pickup truck can help you avoid monthly payments because you will only need to pay for the depreciation value of the truck.

- According to Money Under 30, one of the drawbacks of leasing is that you may have restricted options as far as customization and modifications go.

- According to Experian, the average monthly lease payment in 2019 was $453, compared to $570 for financed vehicles.

Understanding Different Truck Types and Sizes

Understanding the different types and sizes of pickup trucks is key to making an informed decision on which one to lease. SUVs are larger, especially when compared to a mid or full-size truck. This can be beneficial for those who need more space for passing passengers or hauling heavier items; however, it conversely requires more fuel and comes with the added cost of insurance. On the other hand, a smaller vehicle such as a compact might offer better fuel efficiency when travelling but may not have enough capability to haul as much weight as larger vehicles. That said, there are advantages to all size trucks—it just depends on what your priority space and budget needs are.

If you’re still unsure of which size truck is right for you, consider going on test drives with representatives from the dealership. During a test drive, you can get a feel for how the truck handles and if it offers enough power for your job; this may help you decide if a mid, full, or compact size will best suit your needs. Plus, if you’re able, it could be helpful to take a look at actual cargo that you’ll be hauling regularly and researching online for opinions about different trucks’ capabilities before leasing.

You’ve put in the time researching sizes and conducting research online – now it’s time to crunch the numbers and see if leasing a truck makes fiscal sense. It’s time to analyze your budget and consider the total cost of leasing a truck.

Analyze Your Budget and Consider the Cost of Leasing a Truck

Now that we have covered the different types of truck sizes and shapes, it is important to consider the cost of leasing a pickup truck. Leasing a truck can definitely come with its own set of advantages. It often comes with lower monthly payments than buying, and immediate access to driving a newer model, but make sure you understand exactly what you owe before signing any paperwork. Analyzing your budget should be the first step and ask yourself if this is an investment that is feasible for you right now.

The cost of leasing a vehicle comes with additional fees such as taxes, registration, and the need to acquire your own auto insurance plan. One factor to consider when exploring suitable payment plans is understanding the length of your lease and develop an accurate estimate on the total cost. Don’t forget to check in on additional costs like maintenance because it could add up quickly over time.

Leasing a truck might sound like an attractive option for someone on a budget, however there are some things to consider regarding ownership versus leasing. On one side, purchasing a vehicle will give individuals full ownership whereas leasing allows them to use the car with restrictions for a fixed period. People who want to keep their trucks in top condition or those who need their truck for heavy hauling should instead opt for buying one outright as it will give them more control over the duration it will remain in serviceable condition.

At this point, it is important to consider all angles and weigh out all potential fee differences before committing either way. Doing so will ensure that readers choose between either leasing or buying a pickup truck comfortably, setting up a workable and optimized budget plan from the start. Ultimately, considering both sides of each argument and carefully analyzing one’s budget are vital steps in obtaining an informed decision on whether or not to purchase or lease a pickup truck.

Once readers are comfortable about their decision-making process regarding purchasing or leasing a pickup truck, they can continue onto creating their payment plan according to their unique lifestyle needs.

Key Points to Remember

When considering leasing or purchasing a pickup truck, it is important to understand the cost of leasing, including additional fees such as taxes, registration, and insurance. Analyze your budget and determine if leasing is feasible right now. Ownership gives you more control over the maintenance duration while leases have restrictions for a fixed period. Analyze each side and decide which one best fits your lifestyle needs.

Setting a Payment Plan and Budget

When it comes to setting a payment plan and budget for leasing a truck, it ultimately depends on your financial situation, and the cost of the lease itself. Making sure to adequately research and analyze your budget is paramount to making sure you don’t overcommit financially. Oftentimes, when leasing a truck, there will be an initial upfront charge that needs to be paid. This charge can be usually upwards of several thousands of dollars. Therefore, it’s crucial to assess whether you can afford such a hefty cost at the outset. Additionally, there will be varying monthly payments depending on the length of the lease and other factors, such as if any additional features were added on or if maintenance costs are included in the rental agreement.

An important point to recognize is that leasing a truck may not always make financial sense. When considering whether or not leasing is best for you, compare the difference between lease payments and financing a purchase outright for the same vehicle. Depending on your budget, you could potentially save more money by purchasing in full rather than leasing over a set term period. Ultimately though, it’s essential to research and calculate potential costs of each option to access which makes sense for you.

At any rate, choosing how best to pay either through purchase or rental is only one part of a much bigger equation when looking into leasing trucks. Moving forward from here, it’s time to review some additional associated costs involved in truck rentals before proceeding with committing to a lease agreement.

Consider Additional Costs Involved with Leasing a Truck

Now that you have weighed your options, and chosen to lease a pickup truck, it’s important to consider additional costs involved. There are more than just the payments you make each month; insurance, gas, and maintenance are all important factors to consider when looking into leasing a pickup truck.

When looking into the cost of an insurance plan for a pickup truck that is leased, there are two sides of the argument. Some believe that leasing allows for lower insurance costs because drivers don’t own the vehicle itself and hence will not face as much financial loss if something were to happen. Another perspective holds that if the car needs repairs post-crash, the user would be responsible for them and therefore will need to acquire higher coverage in order to compensate for those kinds of losses. According to CarInsurance.com, “Leasing a car can sometimes mean paying higher premiums. […]. In some cases, leasing can increase insurance rates by up to 20%.” This evidence points to acquiring higher coverage when considering insurance for a leased pickup truck.

Gas is also an important factor to consider before committing to a lease agreement with a dealership. While most pickups boast good fuel economy, the added weight of materials driving around with you in addition to the size of the vehicle itself will add more wear-and-tear on your wallet over time as you fill up at the pump. Be sure you factor this into your budget so you can continue using your truck without accessing more financial resources than were initially planned for.

Finally, maintenance for a leased vehicle is definitely something one should be mindful of when considering leasing a pickup truck. Try to keep up on oil changes as often as possible so that greater engine issues won’t arise which could result in larger bills from repair shops. Having said that, be sure that what ever lease agreement you enter into details its maintenance requirements clearly at the start so that proper care is taken while using it throughout your time as its leaser.

Putting together all these factors when deciding whether or not leasing a truck is right for you can be a tricky balancing act; however, if done properly it can set up yourself nicely for years ahead of use. Next we’ll look at how understanding insurance and maintenance costs involved with such a decision can help in making this choice easier.

Maintenance and Insurance Costs

It’s not just the monthly payments that you need to consider when leasing a pickup truck; maintenance and insurance costs should also play a role in your decisionmaking. When it comes to maintenance costs, these are often higher than with smaller cars because pickup trucks have more complicated mechanical systems. Be sure to factor in the cost of regular oil changes, tire rotations, and brake repairs that will be necessary while leasing a pickup truck.

On the other hand, some people argue that maintenance costs may be offset by higher resale value and lower depreciation associated with larger vehicles like trucks. They also point out that the size and weight of pickups may make them less prone to wear and tear, which could help offset long-term maintenance costs over time.

Insurance premiums for pickup trucks are typically higher than with sedans because they tend to cost more to replace and carry more liability risk when driven. On the other hand, this additional expense may be off-set by their greater payload capacity, which can sometimes eliminate the need for renting a van or trailer when hauling heavy cargo loads — something that is not always covered by car insurance policies.

In short, there are a lot of different factors to consider when factoring in maintenance and insurance costs associated with leasing a pickup truck. Estimating these upfront can help you plan ahead and account for those expenses when making a decision about which vehicle makes financial sense for you. As you move forward in your plan to lease a pickup truck, now would be an opportune time to collect information on the various model options available on the market today. This will help ensure you find one that meets both your needs and budget requirements down the road.

Collect Information on the various Truck Models Available

Now that you’ve factored in what leasing a pickup truck could potentially cost in terms of maintenance and insurance, it’s time to assess the various models available to you when deciding which truck is best suited for your needs. Whether you’re looking for a heavy duty vehicle with plenty of hauling capacity or something more lightweight for occasional trips to the hardware store, there are many factors you’ll need to consider as you compare the different options.

It can be helpful to research specifications like gross vehicle weight ratings or payload capacities that will let you know how much a given truck can carry and tow. There’s also the cab size, bed length, engine type, fuel economy ratings, and overall cargo space to take into account. It’s important to study up on these so you make sure that whatever model comes home with you will indeed last longer than a few months before needing an upgrade or replacement.

Finally, don’t forget to ask about any add-on features such as side steps, roof racks, toolboxes, running boards, rear view cameras, and more based on what might be necessary for your particular job demands. Taking the time to learn as much as possible about all these attributes will probably go a long way towards helping you make the most informed decision when selecting a truck that meets your needs.

Once you feel confident and have gathered enough information from each option available, it’s time to start comparing features and alternatives so you can settle on the perfect pickup truck lease deal for yourself.

Compare Features and Alternatives

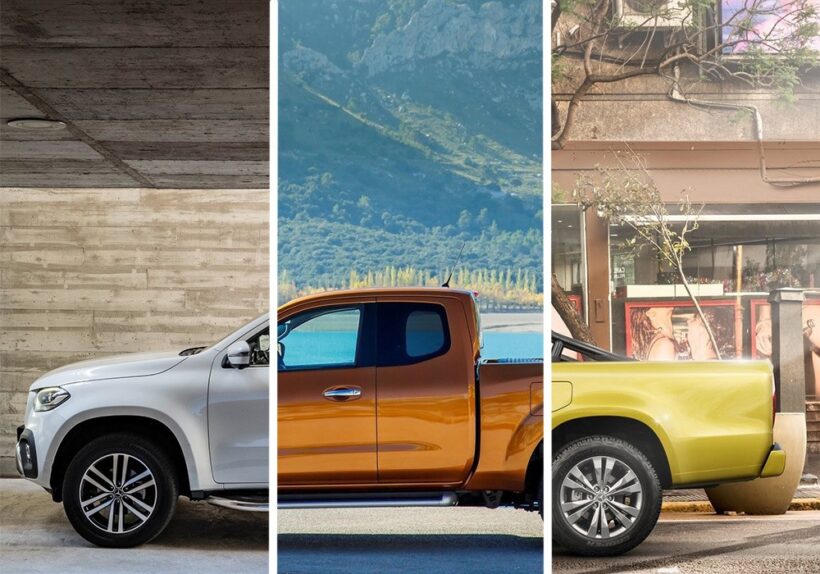

When leasing a pickup truck, it’s important to compare the features and alternatives available in order to make an informed decision. To begin with, when looking at specific models you should consider factors such as towing capacity, gas mileage, safety ratings, and of course, cost. Each model can come with different features or packages that may be best suited for the individual’s needs. For example, someone who is regularly towing a trailer would likely require more power than someone who only uses their truck for weekend errands.

Another factor to consider when leasing a pickup truck is completing an analysis of the alternatives available. Generally speaking, potential buyers have two choices: a new or used model. A new vehicle offers certain advantages such as reliability and optimal performance that you can expect from a brand-new model and better warranty coverage. On the other hand, used models may provide a better value because of depreciation associated with new vehicles that cause a drop in price over time.

Ultimately the buyer must decide which factors and alternatives are best suited for their needs and budget before making any commitments. Comparing models from different manufacturers can be beneficial but may become overwhelming so it helps to narrow down the selection based on predetermined criteria related to doable tasks, budget, and desired features. Having knowledge on each manufacturer’s reputations and quality rankings can help identify which brands offer greater satisfaction or value. In addition, gathering feedback from trusted sources such as family members or friends who have purchased the same type of vehicle can help buyers develop an understanding about personal experiences with particular models or manufactures. The aim is to make sure that buyers have sufficient information before making any commitment whether it’s buying new or used.

Answers to Frequently Asked Questions

What are the benefits and drawbacks of leasing a pickup truck?

The main benefit of leasing a pickup truck is that it allows you to drive a higher value vehicle for a lower monthly cost than if you purchased it outright. Additionally, since the truck’s value is fixed at the end of the lease, you know ahead of time how much you will owe when the lease ends. Furthermore, because leasing often requires little or no down payment, it can be an affordable way to enter into Vehicle Ownership with minimal upfront costs.

The main drawback of leasing a pickup truck is that it often comes with restrictions related to things such as mileage and wear and tear. You’ll also probably need to remain insured on the truck for its duration, which could add to your overall expense. Lastly, when the lease ends, you don’t own the pickup – so if you wanted to keep it, you would have to purchase it or get a new lease on it.

What are the most important questions to ask when leasing a pickup truck?

When leasing a pickup truck, the most important questions to ask are:

1. What is the total cost for the lease, including taxes and fees? You want to make sure you understand what you’ll be paying in order to avoid any surprises.

2. Is there an option for an extended warranty? An extended warranty can give you peace of mind in case of any mechanical or maintenance issues that may arise during the course of your lease.

3. Does the lease come with roadside assistance? If not, is it possible to add it on? Roadside assistance can be a lifesaver in the event that you get stuck due to breakdowns or other occurrences while on the road.

4. What kind of vehicle inspection is required before signing the lease agreement? Knowing what will be checked up on prior to signing can help ensure that you won’t run into any unwarranted charges or expenses later down the line.

5. What penalties apply if you break your lease early? Make sure you understand all of the repercussions of breaking your lease before signing so that you’re well prepared if such a situation arises.

What are the typical terms and conditions associated with leasing a pickup truck?

The typical terms and conditions associated with leasing a pickup truck include:

• Length of the lease – Most leases will be for a specific period of time, typically ranging from 2-3 years.

• Mileage limits – Many leases will come with mileage limits that must be adhered to. The precise mileage limits may vary between leasing providers, so it’s important to check in advance.

• Upkeep requirements – In order to keep the lease in good standing, the vehicle must be regularly maintained according to manufacturer guidelines. This includes regular oil and filter changes, tire rotations, tune-ups, etc.

• Early Termination Fees – If you need to terminate the lease before the scheduled end date, you may be subject to an early termination fee.

• Depreciation Costs – The value of the vehicle depreciates over time and this cost will be passed on to you if you choose not to buy the vehicle, which often makes it more lucrative in the long run to buy instead of lease.

It’s important to read through all of the terms and conditions associated with leasing a pickup truck before signing any agreements.